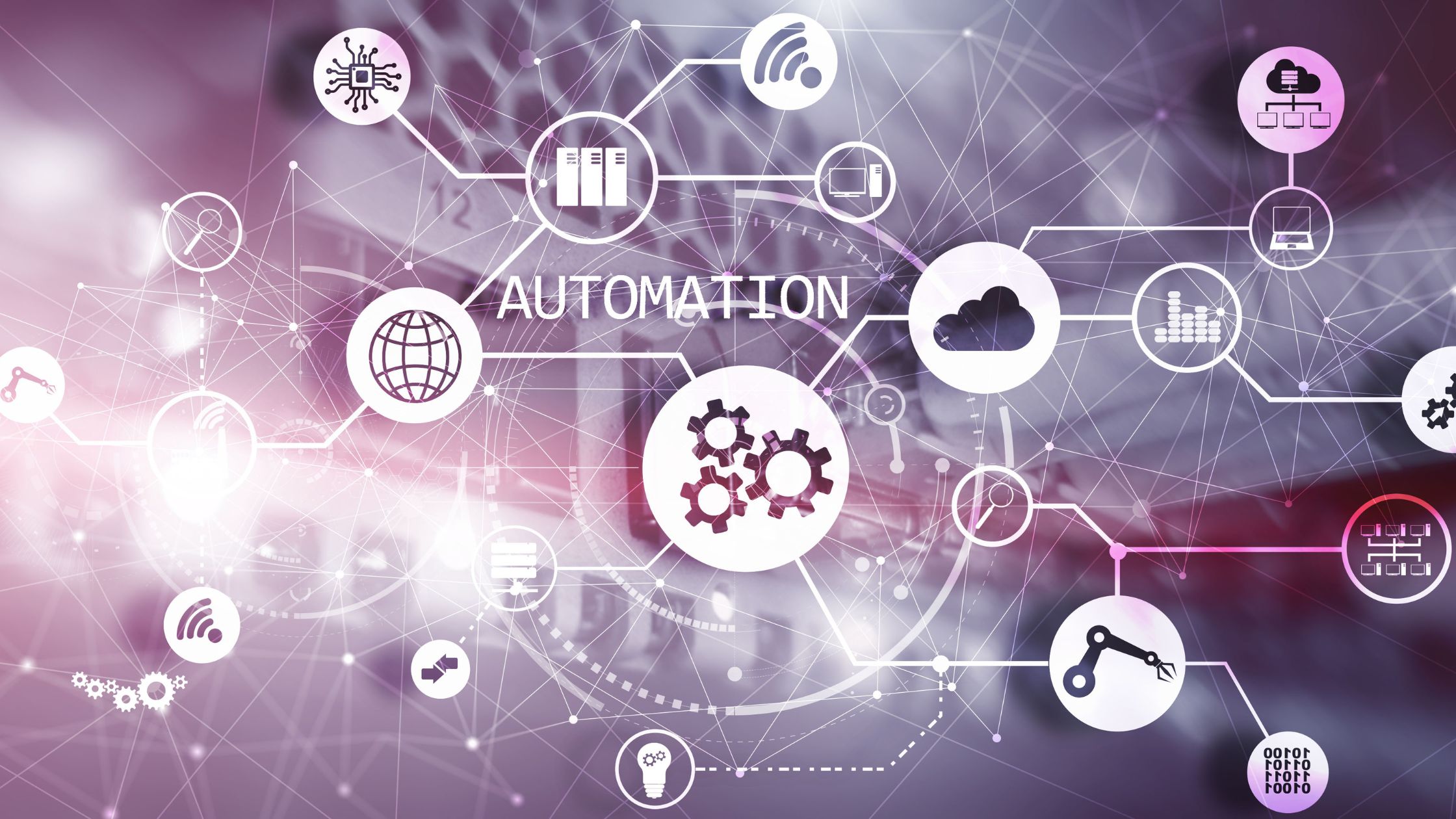

the rapidly evolving landscape of the insurance industry, staying competitive and profitable requires a keen focus on efficiency. One of the most powerful tools at an insurer’s disposal is automation. By streamlining processes, reducing operational costs, and enhancing customer experience, insurance automation can significantly boost efficiency and profitability. In this article, we’ll explore the ways in which insurance automation can be harnessed to achieve these goals.

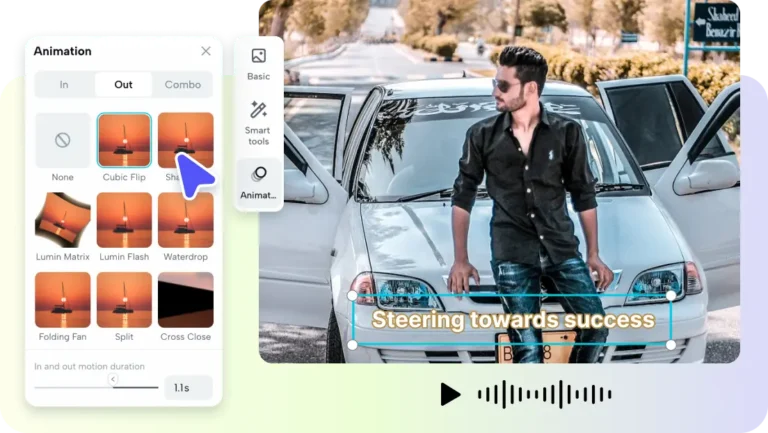

Streamlining Underwriting Processes

Underwriting is a critical aspect of insurance operations, but it can be a time-consuming and resource-intensive process. Robotic process automation can significantly expedite underwriting by utilizing predictive analytics and artificial intelligence to assess risk. This not only reduces the time required to underwrite policies but also ensures more accurate risk assessment, leading to better risk selection. This results in a decreased number of claims, ultimately increasing profitability.

Enhanced Claims Processing

Claims processing is a pivotal function of insurance companies, and it’s often a bottleneck in terms of efficiency. With process automation, claims can be processed more quickly and accurately. AI-powered algorithms can detect fraudulent claims, leading to substantial cost savings. Additionally, automation allows for better communication with claimants, ensuring a smoother and more satisfying customer experience, which can enhance customer retention and reputation.

Customer Service Automation

Customers today expect quick and efficient service. Automation tools like chatbots and virtual assistants can provide 24/7 support, answering queries, assisting with policy management, and even guiding clients through the claims process. This not only enhances customer satisfaction but also reduces the burden on customer service staff, allowing them to focus on more complex issues and improving overall efficiency.

Data Analytics for Improved Decision-Making

Data is the lifeblood of the insurance industry. Automation can help insurers collect, analyze, and leverage data more effectively. Advanced analytics tools can identify trends, customer behavior patterns, and other insights that can inform strategic decisions. This allows insurers to tailor their products, pricing, and marketing strategies for maximum profitability.

Policy Administration Automation

Handling policy administration, including policy issuance, renewals, and endorsements, can be a time-consuming and error-prone task. Automation can simplify and expedite these processes. Insurers can automate policy document generation, validation, and delivery, ensuring compliance and reducing the potential for costly errors.

Marketing and Customer Acquisition

Automation can optimize marketing efforts and lead generation. By leveraging data analytics and customer profiling, insurers can identify high-potential prospects and create targeted marketing campaigns. Additionally, automated lead nurturing processes can be put in place to guide potential customers through the sales funnel, increasing conversion rates and profitability.

Regulatory Compliance

Staying compliant with the ever-evolving insurance regulations is a challenging task. Automation can help insurers keep up with compliance requirements by monitoring changes in regulations, ensuring policy documentation is up to date, and automating the submission of necessary reports. This not only minimizes the risk of fines but also reduces the time and effort required for compliance tasks.

Fraud Detection and Prevention

Insurance fraud is a significant cost factor for insurers. Automation can play a vital role in identifying and preventing fraudulent claims. AI algorithms solution can analyze claim data in real-time, flagging suspicious patterns and behaviors for further investigation. This proactive approach can save insurers substantial amounts of money.

Cost Reduction

Automation can lead to significant cost reductions in various aspects of insurance operations. By automating routine and time-consuming tasks, insurers can reallocate human resources to more strategic roles, leading to higher productivity and reduced labor costs. Moreover, efficiency gains can also reduce overhead and operational expenses.

Data Security

With the increasing reliance on digital data, data security is a top priority for insurers. Automation can enhance data security by implementing robust encryption, access controls, and monitoring systems. This not only safeguards sensitive customer information but also minimizes the risk of data breaches, which can lead to significant financial losses and reputational damage.

Conclusion

In an industry where efficiency and profitability are paramount, insurance automation has emerged as a powerful ally. By streamlining underwriting, claims processing, and policy administration, automating customer service, and leveraging data analytics, insurers can realize substantial gains in both efficiency and profitability. Furthermore, automation enhances customer satisfaction, reduces operational costs, and helps insurers stay compliant with regulations and combat fraud.

For insurance companies looking to thrive in a competitive landscape, embracing automation is not just an option; it’s a necessity. The future of the insurance industry belongs to those who can harness the potential of automation to its fullest, ultimately leading to increased efficiency and profitability.

Robotic Process Automation is a transformative technology that offers numerous benefits to enterprise solutions. From improved efficiency and cost reduction to enhanced accuracy and customer satisfaction, RPA is changing the way businesses operate. It enables organizations to adapt to the ever-evolving business landscape, gain a competitive advantage, and achieve better results. By embracing RPA, enterprises can position themselves as innovators in their respective industries, paving the way for a more efficient and prosperous future.